While US public companies have been navigating ASC 842 (Leases) for some time, private companies in the US are also now subject to these significant changes in lease accounting. The standard requires most leases to be recognized on the balance sheet, impacting financial statements and key financial metrics.

Key implications of ASC 842 for US private companies include:

- Balance Sheet Recognition: Operating leases, previously off-balance-sheet, are now recognized as right-of-use (ROU) assets and lease liabilities.

- Changes in Financial Ratios: The capitalization of operating leases affects financial ratios such as debt-to-equity and asset turnover.

- Data Collection and Management: Private companies need to gather and manage significant amounts of lease data, including lease terms, payment schedules, and discount rates.

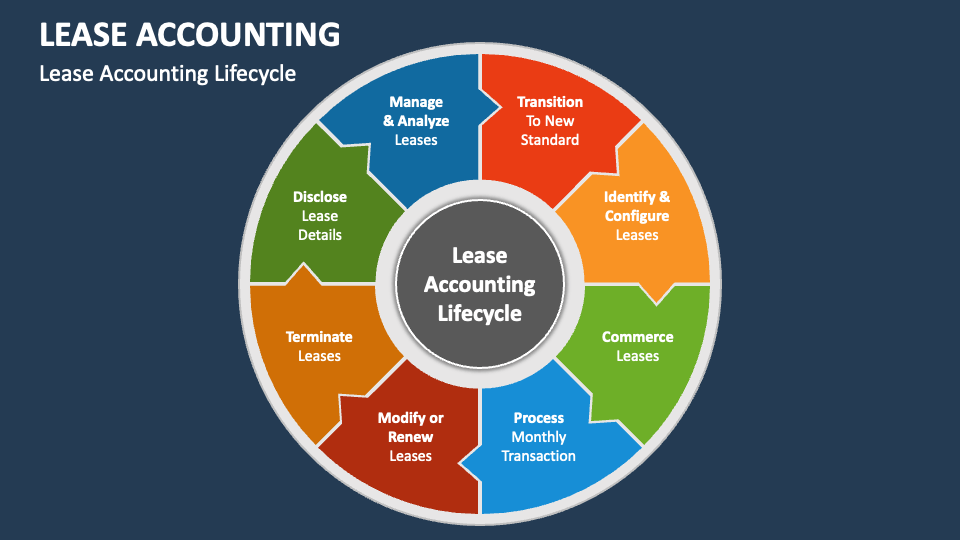

- Implementation Challenges: Transitioning to the new standard can require significant effort in terms of system updates, process changes, and employee training.

- Impact on Loan Covenants: The changes to balance sheets may affect compliance with existing loan covenants.

- Ongoing Accounting and Reporting: Private companies need to establish processes for the ongoing accounting and reporting of leases under ASC 842.

US accounting and finance professionals in private companies are actively working to implement the new lease accounting standard, understand its implications, and ensure accurate financial reporting.

What have been some of the biggest challenges your US-based private company has faced with the implementation of ASC 842? What advice would you offer to others going through this transition? Share your insights!