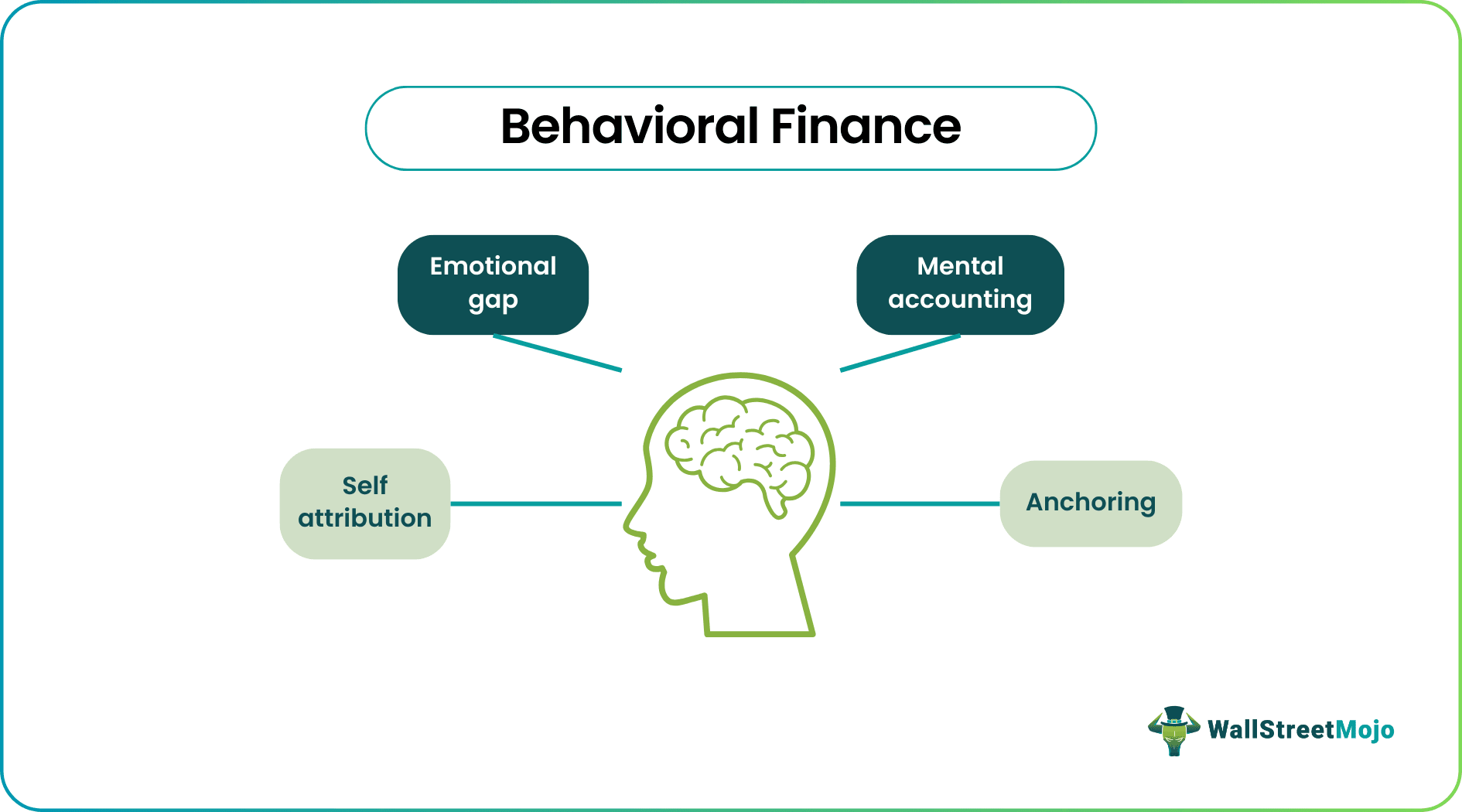

Behavioral finance has gained significant traction in the US investment community by recognizing that psychological biases can significantly influence investors’ decision-making, often leading to irrational outcomes that deviate from traditional economic models. Understanding these biases is crucial for both investors and finance professionals.

Key concepts in behavioral finance relevant to US investment decisions include:

- Loss Aversion: The tendency for individuals to feel the pain of a loss more strongly than the pleasure of an equivalent gain.

- Confirmation Bias: The inclination to seek out information that confirms pre-existing beliefs while ignoring contradictory evidence.

- Herding Behavior: The tendency to follow the actions of a larger group, even if it contradicts one’s own analysis.

- Anchoring Bias: Relying too heavily on the first piece of information received when making decisions.

- Availability Heuristic: Overestimating the likelihood of events that are easily recalled or readily available in memory.

- Framing Effects: The way in which information is presented can influence decisions.

By understanding these and other behavioral biases, US investors can become more aware of their own potential irrationalities and strive to make more objective and informed investment choices. Finance professionals can also leverage behavioral finance principles to better understand client behavior and design more effective financial products and advice.

How aware are you of your own behavioral biases when making investment decisions? What strategies do you use to mitigate their impact? Share your insights!