The Impact of Blockchain Technology on US Accounting and Finance 🔗💰

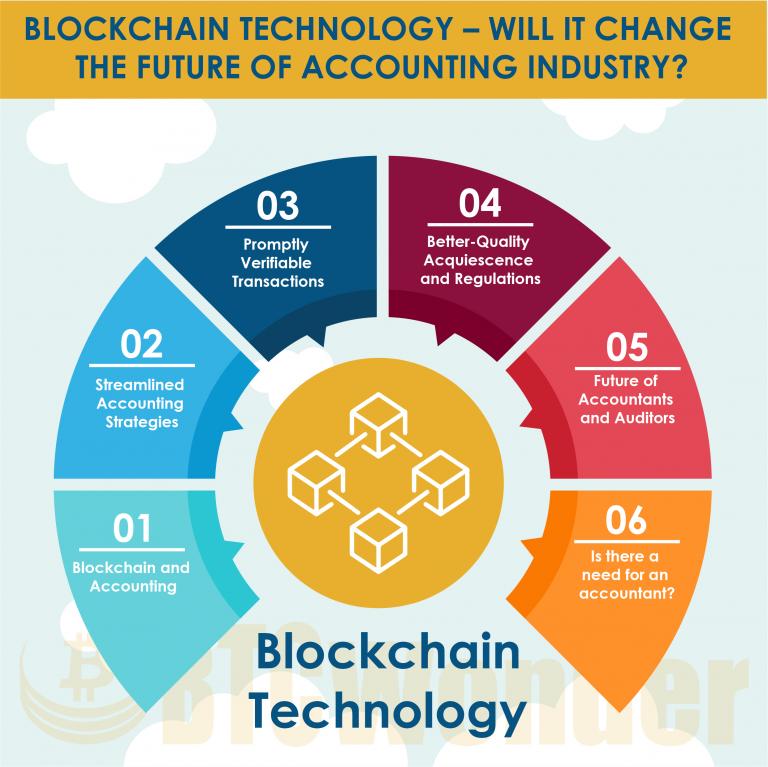

Blockchain technology, with its decentralized and transparent ledger system, holds significant potential to transform various aspects of accounting and finance in the US. While still in its early stages of adoption in mainstream finance, its capabilities offer opportunities for increased efficiency, security, and transparency.

Potential impacts of blockchain on US accounting and finance include:

- Enhanced Transparency and Auditability: Blockchain’s immutable record-keeping can provide a more transparent and easily auditable trail of financial transactions.

- Smart Contracts for Automated Processes: Smart contracts can automate the execution of financial agreements based on pre-defined conditions, potentially streamlining processes.

- Improved Supply Chain Finance: Blockchain can facilitate more efficient and secure tracking of goods and payments across supply chains.

- Digital Assets and Cryptocurrencies: Blockchain is the underlying technology for cryptocurrencies, requiring accountants and finance professionals to develop expertise in this area.

- Secure Data Sharing: Permissioned blockchains can enable secure and controlled sharing of financial data among authorized parties.

- Streamlined Reconciliation: The shared and distributed nature of blockchain ledgers could potentially simplify and speed up reconciliation processes.

While challenges related to regulation, standardization, and scalability remain, blockchain technology has the potential to significantly impact the future of accounting and finance practices in the US. Finance and accounting professionals need to stay informed about these developments to leverage its potential benefits.

What areas of accounting and finance in the US do you believe are most likely to be transformed by blockchain technology? What are some of the key hurdles to wider adoption? Share your insights!