Recent years have highlighted the vulnerability of global supply chains, and these disruptions have had a significant impact on financial planning and analysis (FP&A) for US businesses across various sectors. The ability to accurately forecast, budget, and manage costs has become more challenging in the face of unpredictable supply chain dynamics.

Key ways supply chain disruptions are affecting US FP&A:

- Increased Forecasting Complexity: Fluctuations in lead times, material availability, and transportation costs make revenue and cost forecasting significantly more difficult.

- Inventory Management Challenges: Companies are grappling with decisions around inventory levels, balancing the risk of stockouts with the costs of holding excess inventory.

- Cost Volatility: Unpredictable price changes for raw materials, components, and shipping impact cost of goods sold and overall profitability.

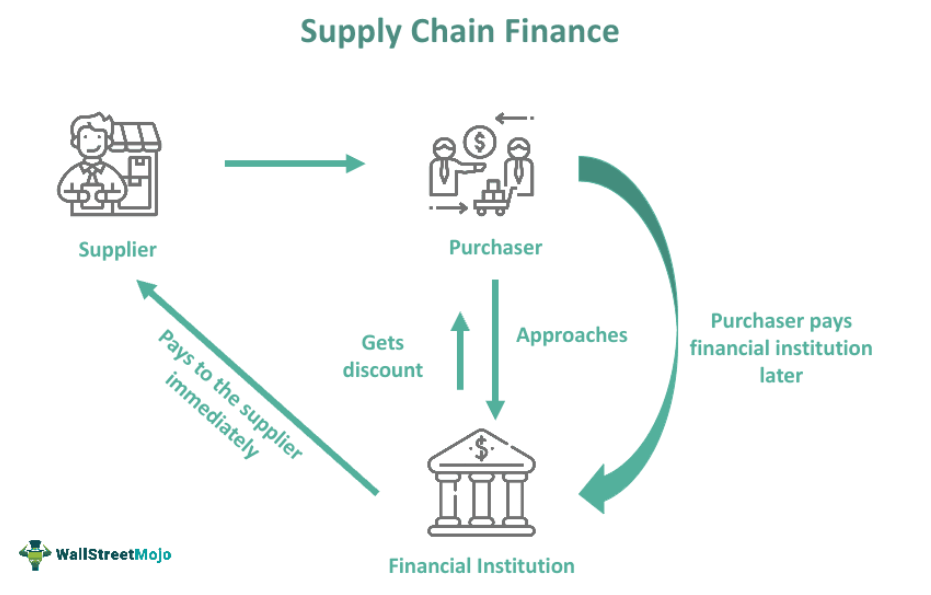

- Working Capital Management: Extended lead times and inventory buildup can tie up significant working capital.

- Scenario Planning Importance: FP&A teams are increasingly relying on scenario planning to model the potential financial impact of various supply chain disruptions.

- Need for Closer Collaboration: Enhanced communication and collaboration between finance, procurement, and operations teams are crucial for navigating these challenges.

US finance professionals are adapting their FP&A processes to incorporate supply chain risks and uncertainties, emphasizing agility, data-driven insights, and closer collaboration to mitigate potential financial impacts.

How have supply chain disruptions impacted your FP&A processes in the US? What strategies have you found effective in navigating these challenges? Share your insights!