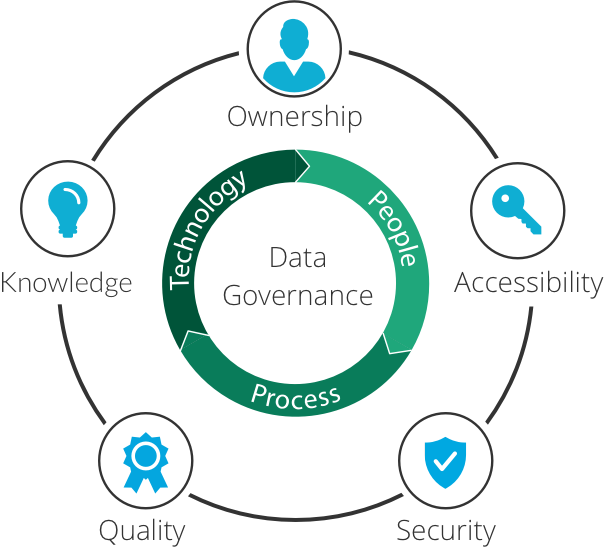

In today’s data-driven environment, effective data governance is becoming increasingly critical for finance and accounting teams within US organizations. Establishing clear policies and procedures for managing data ensures its quality, integrity, security, and compliance, ultimately leading to more reliable financial reporting and better decision-making.

Key aspects of data governance in US finance and accounting include:

- Data Quality Management: Implementing processes to ensure the accuracy, completeness, and consistency of financial data.

- Data Security and Privacy: Establishing controls to protect sensitive financial information and comply with relevant regulations.

- Data Lineage and Audit Trails: Maintaining a clear understanding of where financial data originates and how it is processed.

- Master Data Management: Ensuring consistent and accurate definitions for key data elements across different systems.

- Data Access and Authorization: Defining who can access specific financial data and implementing appropriate controls.

- Compliance and Regulatory Reporting: Ensuring that financial data used for reporting meets all legal and regulatory requirements.

Effective data governance in finance and accounting not only enhances the reliability of financial information but also supports better analytics, improved risk management, and increased trust among stakeholders. US organizations are recognizing the need to invest in data governance frameworks and technologies to effectively manage their financial data assets.

How is your US-based organization approaching data governance within its finance and accounting functions? What are some of the key challenges you are addressing? Share your insights and strategies!